How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Table of ContentsThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingWhat Does Mileagewise - Reconstructing Mileage Logs Mean?Our Mileagewise - Reconstructing Mileage Logs StatementsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedA Biased View of Mileagewise - Reconstructing Mileage LogsNot known Details About Mileagewise - Reconstructing Mileage Logs The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Range function recommends the fastest driving path to your staff members' destination. This function boosts efficiency and adds to set you back savings, making it a necessary possession for companies with a mobile workforce.Such a method to reporting and conformity simplifies the commonly complex job of taking care of gas mileage expenditures. There are several benefits linked with using Timeero to maintain track of gas mileage.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

These added verification actions will certainly maintain the Internal revenue service from having a reason to object your mileage records. With exact gas mileage tracking technology, your workers don't have to make harsh mileage estimates or even worry about mileage expenditure monitoring.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all cars and truck expenses (simple mileage log). You will certainly need to proceed tracking gas mileage for work even if you're using the real expenditure method. Keeping mileage documents is the only way to different service and individual miles and supply the evidence to the IRS

A lot of mileage trackers allow you log your journeys manually while calculating the distance and repayment quantities for you. Several additionally come with real-time journey tracking - you need to start the app at the beginning of your trip and stop it when you reach your final destination. These applications log your start and end addresses, and time stamps, together with the overall range and compensation quantity.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

This consists of expenses such as fuel, maintenance, insurance coverage, and the vehicle's devaluation. For these costs to be considered insurance deductible, the lorry should be utilized for service objectives.

Some Known Facts About Mileagewise - Reconstructing Mileage Logs.

Start by tape-recording your automobile's odometer analysis on January first and afterwards again at the end of the year. In in between, faithfully track all your organization journeys writing the beginning and finishing analyses. For every trip, record the location and business objective. This can be streamlined by keeping a driving visit your auto.

This includes the overall organization mileage and total mileage accumulation for the year (company + individual), journey's date, destination, and objective. It's essential to videotape activities immediately and maintain a synchronous driving log describing date, miles driven, and organization objective. Below's exactly how you can enhance record-keeping for audit objectives: Begin with making sure a meticulous mileage log for all business-related travel.

The Mileagewise - Reconstructing Mileage Logs Statements

The real expenditures method is an alternate to the conventional mileage rate method. Instead of determining your reduction based on an established rate per mile, the real expenditures technique enables you to subtract the actual costs associated with utilizing your lorry for company purposes - free mileage tracker. These prices consist of gas, maintenance, repair work, insurance coverage, devaluation, and other associated expenditures

Those with significant vehicle-related expenses or special problems might profit from the actual costs approach. Inevitably, your picked method should straighten with your certain economic goals and tax obligation scenario.

Mileagewise - Reconstructing Mileage Logs for Dummies

(https://www.storeboard.com/mileagewise-reconstructingmileagelogs)Whenever you use your vehicle for organization journeys, tape-record the miles traveled. At the end of the year, once again keep in mind down the odometer reading. Determine your complete business miles by utilizing your start and end odometer readings, and your videotaped service miles. Accurately tracking your specific gas mileage for service trips help in corroborating your tax reduction, specifically if you choose the Standard Gas mileage approach.

Keeping track of your gas mileage by hand can require persistance, but remember, it can conserve you money on your taxes. Tape-record the overall more helpful hints mileage driven.

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

And currently almost every person utilizes General practitioners to get around. That means almost every person can be tracked as they go concerning their service.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Lacey Chabert Then & Now!

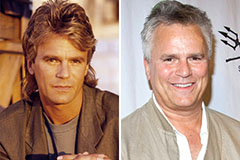

Lacey Chabert Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!